If you are a self-employed professional or small business owner with a high annual income, you may be paying more in taxes than you need to, and you may be limiting what you save for retirement.

A small business defined benefit (DB) plan will allow you to hold onto more of what you earn. This IRS-approved qualified retirement plan allows for higher tax-deductible contributions than other plans and could save you $40,000 or more in taxes each year.

But you need to act now to set up a plan before December 31, 2015 to save for tax year 2015.

But you need to act now to set up a plan before December 31, 2015 to save for tax year 2015.

Defined benefit plans enable self-employed professionals and small business owners to save on taxes and build a large retirement nest egg in a very short time. DB plan owners can accumulate as much as $1,000,000 to $2,000,000 in a tax-deferred retirement account in just 5-10 years. These plans enjoy several powerful features:

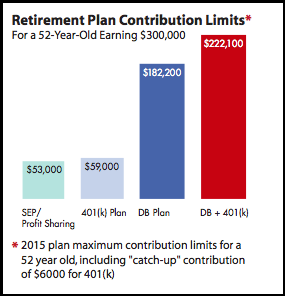

- Highest allowable contributions to a qualified plan: $100,000+ (much higher than the contribution limits on SEP-IRAs and 401(k)s)

- Annual tax savings of $40,000 or more

- Investments grow tax-deferred, building wealth faster

- Tax-free rollover to an IRA at retirement (or plan termination)

- Flexible range of investment choices

Defined benefit plans are not appropriate for everyone, but you could benefit if you are:

- Self-employed or a small business owner with up to five employees

- 40 years of age or older

- Willing and able to contribute more than $50,000 annually to a qualified retirement plan and continue this level of funding for at least 3 years

Some professions that typically benefit from DB plans are:

- Architects

- Attorneys

- Consultants

- Contractors

- Independent Corporate Directors

- Dentists

- Doctors

- Entrepreneurs

- Graphic Designers

- Independent Insurance Agents

- Manufacturer’s Reps

- Mortgage Brokers

- Real Estate Agents

- Software Developer

Do you, or does anyone you, know fit this profile? Click here to see how much you can save!

Want more information? Visit us here to find out more. You can also give us a call (619-435-1701) or send us an email (mailto:[email protected]) to get started.

It takes 10 minutes and could save you thousands in taxes!

Remember to act now; plans must be set up by December 31st 2015, to save on taxes for 2015!

Disclosure:

This document is for informational purposes only. Nothing in this report is to be construed as a specific investment recommendation. This document does not constitute the provision of investment advice, which is only provided by Orion Capital Management LLC under a written investment advisory agreement and only in states in which Orion Capital Management LLC is registered or is exempt from registration requirements. Orion is not a tax advisor and does not provide tax advice.

by Peter C. Thoms, CFA

www.orionportfolios.com