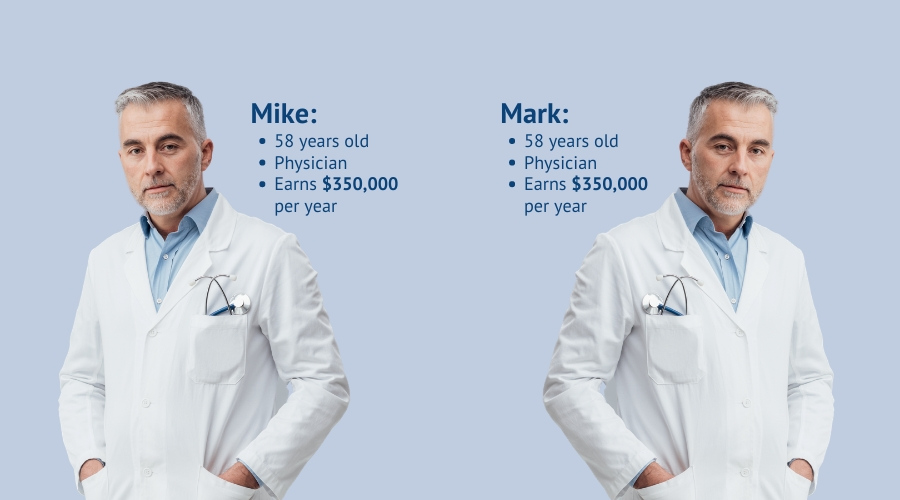

A Tale Of Two Tax Bills

Mike and Mark are identical twins. Both are 58 years old and have successful medical practices. Their practices are precisely the same size, with the same number of employees and the same revenues. They both earn business income of $350,000. The startling difference between them is that Mark’s income tax bill ($122,500 @ 35% rate) is nearly twice as large as his brother’s. How can this be?

If you own a successful small business or professional practice, the single biggest drain on your income and wealth is probably taxes . . . and potentially the best way to start plugging this drain is to make a large, annual, tax-deductible contribution to an IRS-approved qualified retirement plan called a cash balance plan.

Cut Your Taxes And Boost Retirement Savings

Your contributions to your cash balance plan reduce your taxable income dollar-for-dollar. For example, if your taxable income is $300,000 and you then make a $100,000 contribution to your cash balance plan, your taxable income drops to $200,000. This move would save you $35,000 in taxes per year, assuming a 35% tax rate. Now, instead of just writing big checks to the IRS and state for your estimated taxes, you can write them to your own retirement plan as well.

True, few terms sound more boring than “cash balance plan.” But for those who contribute to cash balance plans, saving tens of thousands of dollars each year on taxes while rapidly building a multi-million dollar retirement nest egg can be quite exciting.

Many small business owners start off by contributing to 401(k) plans or SEP-IRAs, but the IRS contribution limits for these plans are much lower than for cash balance plans. As owners get older and their incomes increase, however, the retirement plan calculus changes. More and more, owners of successful businesses are opening cash balance plans to significantly cut their tax bills while accelerating their retirement savings. Some high-income business owners are able to make very large contributions that can enable them to slash their annual tax bill by $40,000, $60,000 or even $100,000, depending on their circumstances.

Cash balance plans are often paired with Safe Harbor 401(k)/profit sharing plans to provide the highest possible tax savings for the business owner.

Unlike a 401(k) plan or SEP-IRA, each cash balance plan is custom-designed to meet the specific tax reduction and retirement savings needs of the business owner. The allowable plan contribution is calculated based on several factors, including age, compensation, and years of employment.

Here are several reasons that cash balance plans are increasingly popular with small business owners and professional practices:

- Large annual tax deductions for business owners

- Much higher contribution limits than other retirement plans

- Flexible structure to meet specific needs of business owners; for example, business partners can have different contribution levels

- Cash Balance Plans allow employers to offer retirement benefits to their employees while retaining a high degree of control over their contributions

- Investments grow tax-deferred, building wealth more rapidly

- Assets are more protected than IRA assets in case of lawsuit or bankruptcy

- At retirement (or plan termination) assets can be rolled into an IRA to continue tax-deferred growth

Is A Cash Balance Plan Right For You?

So, how do you know if a cash balance plan is right for your business? Just ask us. We only need a few pieces of information about your situation to generate a complimentary tax-savings proposal for you. There is no cost to you for this service and no obligation whatsoever.

- Contact Us

- Call us at: 619-435-1701

- Email: [email protected]

- Or fill out our online Tax Savings Analysis Tool:

If you find that a cash balance plan works for your situation, you will have to start soon if you want to save on your 2020 tax bill. Plans must be established by December 31 of the year for which contributions are made. However, it takes time to devise the plan and create the plan documents, and pension administrators are typically very busy in the last couple of months of the year. Thus, it is best to begin the process of establishing your plan right now.

Cash balance plans do not work for everyone, but for those in the right circumstances they can be a very powerful tool for both reducing taxes and building wealth.

Read more about cash balance and defined benefit plans here: