By Peter C. Thoms, CFA

www.orionportfolios.com

Global markets have gotten off to a very rocky start in 2016. The U.S. stock market, as measured by the S&P 500 Index, has lost more than 9% of its value in the first six weeks of the year. U.S. small-cap stocks, as measured by the Russell 2000 Index, are down over 14% since January 1. Oil is down 21%.

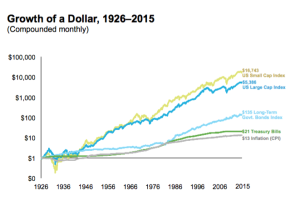

Before we go into the reasons behind the recent market weakness, let’s examine some statistics about both the past performance and the volatility of the U.S. stock market that are critical for today’s investors to understand if they are to stay on their financial course.

In the last 60 years, the U.S. stock market is up nearly 300-fold. (This is simply a remarkable return to be achieved in a span of time that is shorter than the average American’s life expectancy.) However, as investors were earning their 300-fold return over the last 60 years, they spent much of that time nervous and underwhelmed with the markets. In fact, historically the market has spent little time at its highs. Instead, it has spent much more time trading substantially off its highs. Consider the following market insights compiled by investor Michael Batnick and published in Morgan Housel’s column at the Motley Fool, a well-regarded (in my eyes) investment newsletter. In rounded numbers, the market has been:

- At an all-time high just 7% of the time

- 0% to 5% below its all-time high 36% of the time

- 5% to 10% below its all-time high 15% of the time

- 10% to 20% below its all-time high 22% of the time (where we are today)

- 20% or more below its all-time high 21% of the time

Thus, on their way to 300-fold returns, U.S. stock market investors spent nearly 43% of that time with the market down 10% or more from its prior highs.

Just last May the U.S. stock market was at its all-time highs. Today the S&P 500 is down 13% from those levels. Why has sentiment in the markets turned so rapidly? There are three major reasons:

- First, the Federal Reserve has stated its intention to normalize interest rates over the coming years and took its first step in this process in December when it raised rates by 0.25%. Market participants are worried that the Fed will continue to tighten monetary policy even as the global economy slows and as central banks in other developed markets (such as Japan and Europe) continue to loosen policy.

- Second, oil, a commodity hugely important to the world economy, has plummeted in recent months and into 2016. Oil began the new year at $38 per barrel. Today it is at $30. While the oil industry itself is vitally important to government revenues in many countries, investors are also wondering whether the falling price is indicative of a sharp slowdown in global economic activity rather than just too much supply.

- Third, China, which has the world’s second largest economy, is slowing rapidly. The falling rate of investment in China has hit commodity prices and Chinese markets very hard. And with the Chinese government’s proffered economic data deemed less than trustworthy by most global investors, there is certainly justification for traders to shoot (sell) first and ask questions later.

After slogging through 2015, a year in which most asset classes posted declines, investors are rightfully disappointed and concerned with how stocks are behaving so far in the new year.

At such times of volatility, it is critical for investors to keep their eyes on their long-term objectives and not make emotional decisions. In investing—an inherently unpredictable endeavor—it is especially important to put the probabilities on your side. With stocks, this means staying invested through tough times. Investors should keep in mind a persistent trend in stocks: the longer you are invested in stocks, the higher the chance you have of earning a positive return.

Here are some statistics investors should consider that may help them to endure today’s volatility without making any financial decisions that could meaningfully degrade the return potential of their portfolios in the years to come. According to Ibbotson Associates, a market research firm, investors have historically had:

- An 82% chance of earning a positive return with a 1-year holding period

- An 86% chance of earning a positive return with a 5-year holding period

- A 95% chance of earning a positive return with a 10-year holding period

Investors who seek to realize the attractive long-term returns on offer from stocks should strive to take today’s volatility in stride and try to get themselves comfortable with being a little bit uncomfortable.

To learn more about how we manage client portfolios, please visit us at www.orionportfolios.com