Should you try to time your investments in the stock market? Should you try to get out before markets fall or in just before they rise?

At Orion, we believe for two reasons that investors are much better served staying invested through the occasional market indigestion rather than trying to time the market.

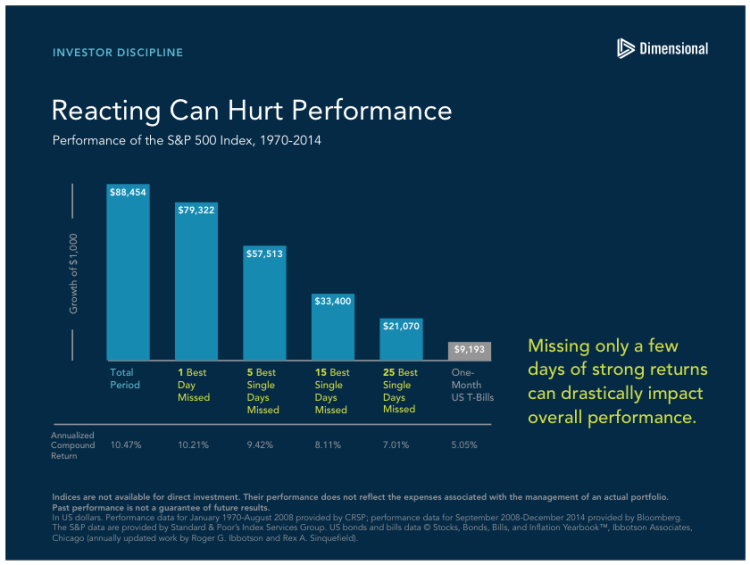

First, markets can make unpredictable and drastic upward and downward moves. While it would be very nice to sidestep some of these downward moves, it is even more important not to miss out on the big upward moves. (In the history of markets, there has been a lot more up than down.) Most, if not all, of the annual return of the stock market can be accounted for in just a few days in which the market roars ahead. It is impossible to know in advance when these days will happen, and if you are out of the market on these days it is very hard to catch up.

The slide below shows just how important it is to be in the market on the massive up days, and what would have happened to your annualized compound return if you had invested $1,000 in 1970 and then missed out on just the best 1,5,15 or 25 days since then.

The second reason we believe investors are better off not trying to time the market is that missing out on a rise in the market creates a permanent lost opportunity. It is certainly not pleasant to be in the market when it moves lower, but unless you just started investing in the last couple of years, nearly all investors that have held a broadly diversified portfolio have recouped any losses (and then some) over time.

Consider an investor who sells, expecting the market to lose 10% or more. But instead the market goes up 10%. What should the investor do? Get back in and make permanent the 10% lost opportunity? Wait longer? What if the market rises another 10%? Investors that try to time the market are very likely to get wrong-footed at some point and to suffer a permanent lost opportunity. Its a risk not worth taking.

Many investors made serious mistakes during the financial crisis of 2008-09, selling in disgust at the bottom and never getting back in to the market. Now they are forever behind.

What can you do to avoid such a mistake during the next downturn?

- Don t commit too much of your portfolio to stocks.

- Expect occasional downturns. They are part of investing.

- Be a contrarian. Add to your stock holdings when they are suffering.

- Use a systematic rebalancing plan to help take the emotion out of investing.

- Know your risk tolerance. (Click here to find out your personal Risk Number in five minutes.)

To learn more about how we manage client portfolios, please visit us at www.orionportfolios.com

By Peter C. Thoms, CFA