By Peter C. Thoms, CFA

January 2016

If you are a high-income professional who is self-employed, owns a small business, or has self-employment income in addition to a salary, you may be paying too much in taxes. But it is not too late to make a last-minute move to save big on your 2015 tax bill.

If you have not already established a retirement plan and contributed a substantial portion of your 2015 earnings to it, act soon to avoid missing out on a great opportunity to boost your retirement next egg while cutting as much as $18,000 from your 2015 tax bill.

Even though 2015 is already over, if you are a self-employed, high-income professional who has not yet established a retirement plan, you still have one retirement plan option remaining to shelter some of your 2015 income from taxes: a SEP-IRA. The two other types of plans that you should consider are defined benefit plans and individual 401(k) plans. Both are superior to SEP-IRAs for different reasons, but they must be established by December 31 of the tax year for which contributions are being made. Thus, while it is too late for 2015, you should definitely consider these plans for 2016.

A Simplified Employee Pension (SEP) IRA, however, is still an excellent option if you have 2015 self-employment income and want to act quickly to reduce your 2015 tax bill.

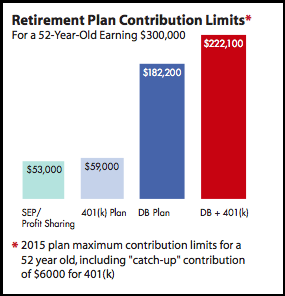

A SEP-IRA is a retirement plan designed to help self-employed individuals and small business owners reduce their tax obligations while building their retirement nest eggs. The 2015 and 2016 SEP-IRA contribution limit is 25% of the plan owner’s W-2 wages or 20% of his or her net self-employment income, up to a maximum of $53,000. The deadline to set up and fund a SEP-IRA is the plan owner’s tax filing date, including extensions. A SEP-IRA is a powerful but easy-to-establish plan: a business owner funding a SEP-IRA to the limit of $53,000 may be able to save $18,000 in 2015 taxes and a similar amount each year in the future.

Defined Benefit Plans

For 2016, the first plan that high-income self-employed professionals should consider is a defined benefit plan. Defined benefit (DB) plans offer by far the highest tax-deductible contribution potential of any retirement plan. In many cases contributions in excess of $100,000 can be made, so DB plan limits are much higher than SEP-IRAs or 401(k) plans. They therefore also offer the largest tax savings opportunity along with the most rapid retirement nest egg growth potential. There is also potential to combine a defined benefit plan with an Individual 401(k) plan for still more tax-savings potential.

Individual 401(k) Plans

If a defined benefit plan is not appropriate, you could then examine the Individual 401(k)—also known as a Solo 401(k). The Individual 401(k) is superior to the SEP-IRA in that, at a given income level, it has higher contribution limits than a SEP. Higher contribution limits mean more tax-savings potential.

All in all, setting up and contributing to a SEP-IRA is a quick and easy way to shelter some 2015 income from taxes while increasing your retirement next egg. It is not the most powerful retirement plan, but it works well in a pinch for those who have not yet established another type of plan.

Please give us a call, visit our website, or send us an email ([email protected]) if you have any questions or would like us to evaluate your situation and to recommend the best possible retirement plan for your particular circumstances.